Verify Your Customer AccountsĬlear up your books by going through all your vendor and lender files. It’s a great way to stay up to date with your businesses’ financial performance while keeping track of your own evaluations. For example, you can tweak a Profit and Loss report so that it only shows the profits and expenses for each individual product. Make use of QuickBooks’ customized report feature to identify the areas of your business that need adjustments. It also allows you to plan for tax season ahead of time and maximize your savings. Creating a profit and loss forecast is important because it gives your business a plan base to bring in more revenue and attract future investments. The best time to do this is in the last quarter of the year, as there are several tax planning activities that need to be reviewed in advance. QuickBooks can help you forecast your business’ activity for the new year by carefully analyzing your accounting records.

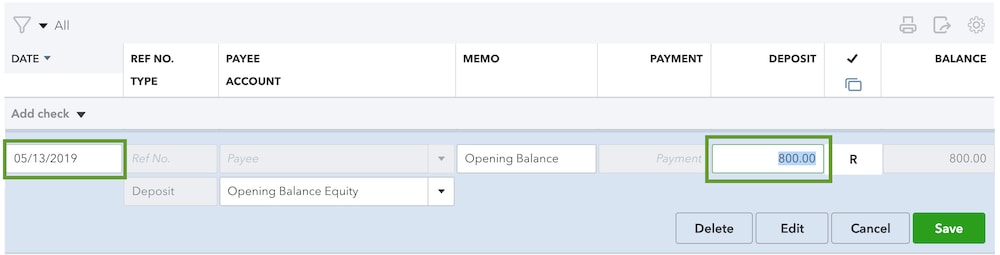

Project Income or Losses for Tax Planning You can also check for losses, determine upcoming promos based on stock available, and true up your inventory with your books. You will want to take stock of everything you have on hand so that you enter the next fiscal year knowing how much money you have tied up in inventory. The Advanced Inventory feature in QuickBooks Enterprise makes this very easy because it integrates natively with a barcode scanner. If these are no longer important to your business then this is a good time to cancel them and recoup the savings. SaaS products, rent or utilities on locations that are no longer relevant, trade publications, or membership organizations will usually just be charged directly to your card. It is also a good way to root out any ongoing charges that you may not want to carry into the new year. ( Watch a tutorial here) It also ensures that the bank and/or credit card company have not made mistakes. This can be tedious but QuickBooks actually makes it relatively easy. It is important to go through your bank statements on a regular basis and ensure there is a matching transaction in QuickBooks for each.

Be able to validate any invoice appearing on the accounts receivable and accounts payable detail reports, and ensure that your previous balance sheet and tax return are a match.

Reconcile Your Balance SheetsĪs dull as it may sound, you have to make sure all bank account reconciliations are complete and cleared of any old deposits or debit transactions. This will translate into a stress-free tax season in April. QuickBooks can help save you valuable man hours due to built-in features for organizing your books. We suggest a structured plan to prepare for your year-end close in QuickBooks. Although reaching the end of another fiscal year is a reason to celebrate, there are additional bookkeeping processes that need to be checked off your to-do list. However, scrambling to close your books in the midst of the holiday season is usually a recipe for errors. This happens a lot and doing a proper year-end close is the easiest way to avoid this issue. It “locks in” your data and ensures you aren’t entering information into the incorrect period. Although your fiscal year may not line up with the calendar year, closing your books properly is still a very important task. Now that we are firmly in Q4 of 2018, it is time to start looking forward to the end of the year.

0 kommentar(er)

0 kommentar(er)